Interest-Only Loans: A Closer Look at the Pros and Cons

- Oct 17, 2024

- 3 min read

Interest-Only Loans: A Closer Look at the Pros and Cons

Once upon a time, interest-only loans were a go-to choice for many borrowers. Back in the day, when interest rates on these loans were comparable to those of principal-and-interest (P&I) loans, opting for an interest-only repayment structure made a lot of sense. It was simple, too—banks could extend your interest-only period with just a click of a button. But times have changed, and so have the rules.

In response to regulatory pressures, banks have had to adjust their approach, encouraging borrowers to pay down their debts. Today, the benefits of interest-only loans aren’t as clear-cut as they once were. Let’s dive into the pros and cons to help you make an informed decision.

The Pros of Interest-Only Loans

Lower Initial Repayments

One of the key advantages of interest-only loans is that they allow for lower repayments initially, as you're only covering the interest without paying down the principal. This can provide short-term cash flow relief, which may be useful in certain circumstances.

Strategic Use for Investors

Some property investors see potential in redirecting the funds that would have gone toward principal repayments into other investments or toward paying down their owner-occupied loan. This strategy might help maximise returns in the short term, depending on individual circumstances.

The Cons of Interest-Only Loans (And Why They Might Not Be Worth It)

Higher Interest Rates

Today, interest-only loans typically come with a much higher price tag—usually 0.35 to 0.50 more basis points than their P&I counterparts. While the initial repayments might be lower, the higher rates mean that you’ll end up paying more interest over the life of the loan. It’s important to consider whether this cost outweighs the short-term relief of lower repayments.

Reduced Borrowing Capacity

Taking on an interest-only loan could limit your borrowing power. When a bank assesses your borrowing capacity for a 5-year interest-only loan, they generally consider repayments over 25 years instead of 30. This means you might qualify for less than you would with a P&I loan—potentially by tens to hundreds of thousands of dollars.

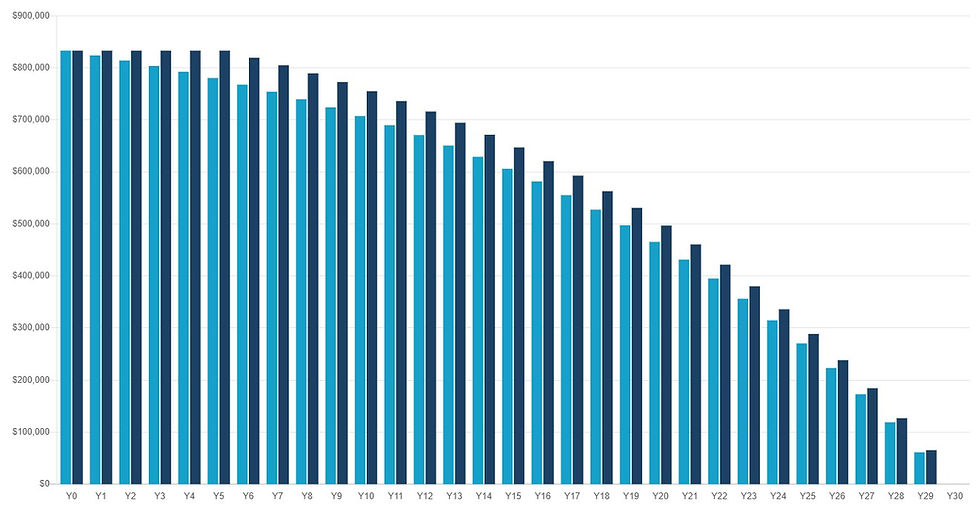

Repayment Shock

This is a big one. When the interest-only period ends, your repayments don’t just transition smoothly—they jump. You’re left with the same loan balance but less time to pay it off. This can result in a significant increase in your monthly repayments. This repayment shock can be a challenge, especially if cash flow has become tighter over time.

More Red Tape and Uncertainty

Gone are the days when extending your interest-only period was a breeze. Now, renewing this structure often requires an "interest only application" to be made, or even a refinance. And if your financial situation changes, you might find it difficult to qualify for another interest-only term. This can leave you facing a tough decision between higher repayments or selling your property.

The Changing Landscape of Interest-Only Lending

All these drawbacks—the higher rates, reduced borrowing capacity, repayment increases, and application hurdles—are part of the banks' “stick” approach, pushing borrowers to pay down their debts. Today, many opt for a principal-and-interest (P&I) loan, making the minimum required repayments while directing any surplus funds into their home loan or an offset account.

This approach allows borrowers to benefit from lower interest rates and build equity steadily, while keeping access to extra funds if needed. It strikes a balance between managing cash flow and reducing debt over time, without the risks associated with interest-only loans.

Ready to Re-Evaluate Your Options?

It’s always important to choose a loan structure that aligns with your financial needs and goals. If you’re wondering whether an interest only loan or a principal-and-interest loan might be a better fit for you, let’s discuss it. Click the button below to book a time in our calendar, and we can explore your options together.

*General Advice Warning: This article is intended to provide general information only and does not consider your individual circumstances. Please seek personalised advice before making any financial decisions.*

Comments